As an experiment, I’m starting a series of posts covering companies I find interesting in Japan.

The first company I’m covering is a company called MonotaRO, a B2B marketplace that sells factory materials and parts such as bolts, joints, machinery parts, etc. to companies in the auto maintenance & repair, construction, and manufacturing industry. MonotaRO is listed on the Tokyo Stock Exchange with more than a $3.5B market cap.

There are 10M products on the marketplace and have 338 full-time employees and 973 part-time employees.

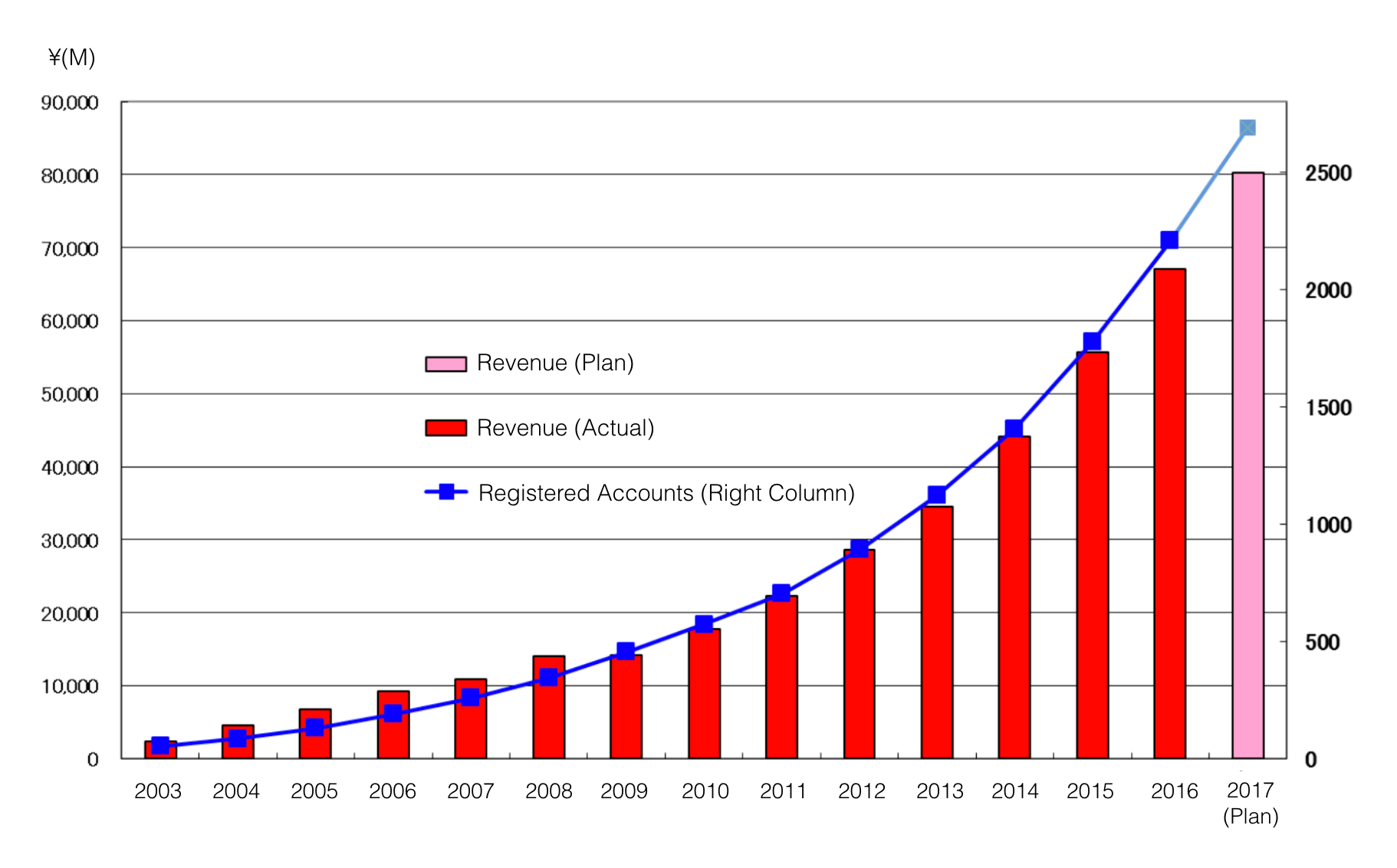

2016 revenue for their Japan operations ended with $584M (+20.7% y/y), operating income was $85.2M (+32.8% y/y), and net income of $57.7M (+40.5% y/y).

They have been showing a pretty healthy growth adding 430,857 new user accounts since December of 2015 and now has a total of 2,207,427 accounts on the platform.

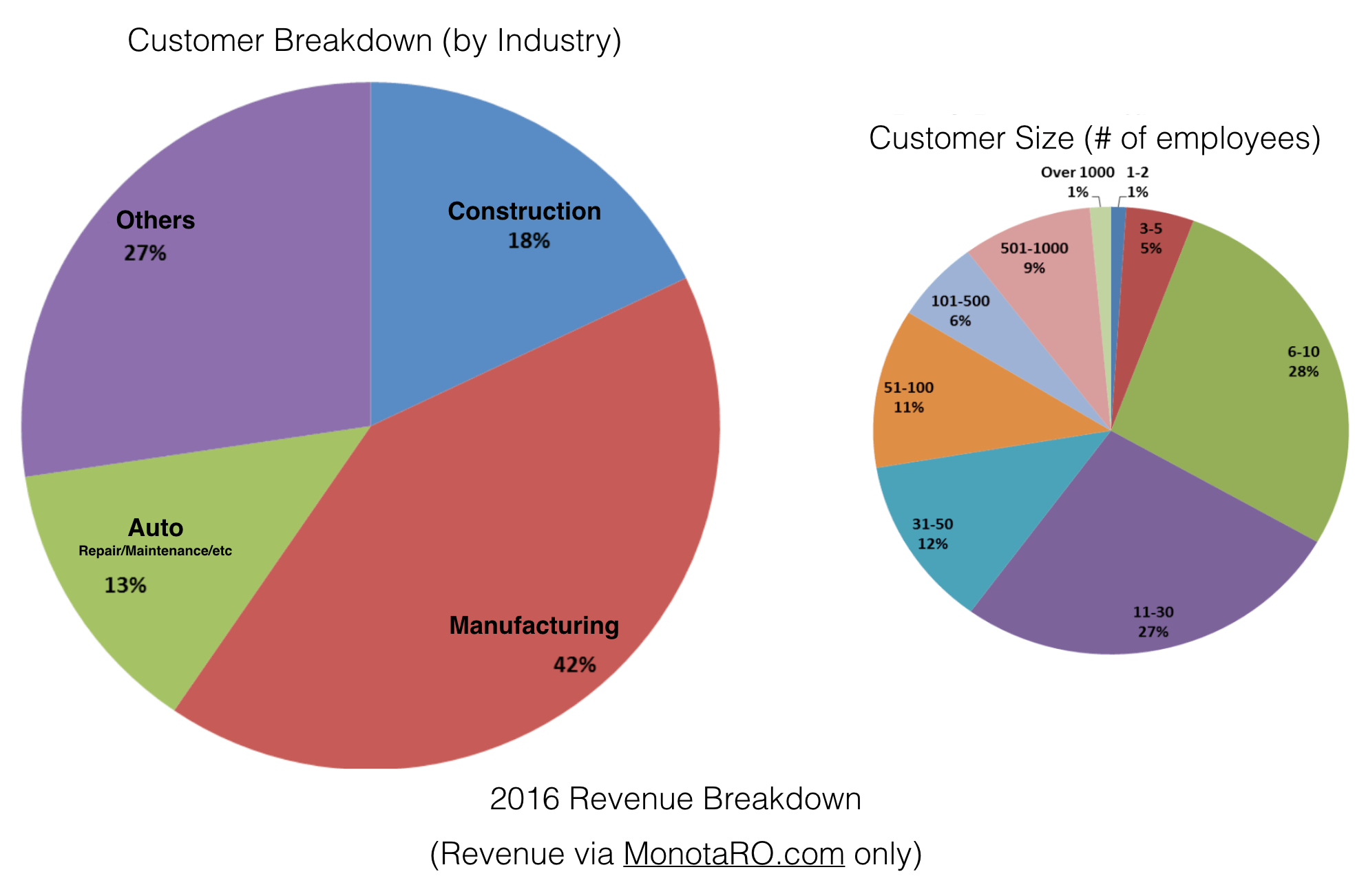

Below are some graphs on their revenue breakdown. Most of their customers come from the manufacturing industry and 55% of their customers have 6~30 employees.

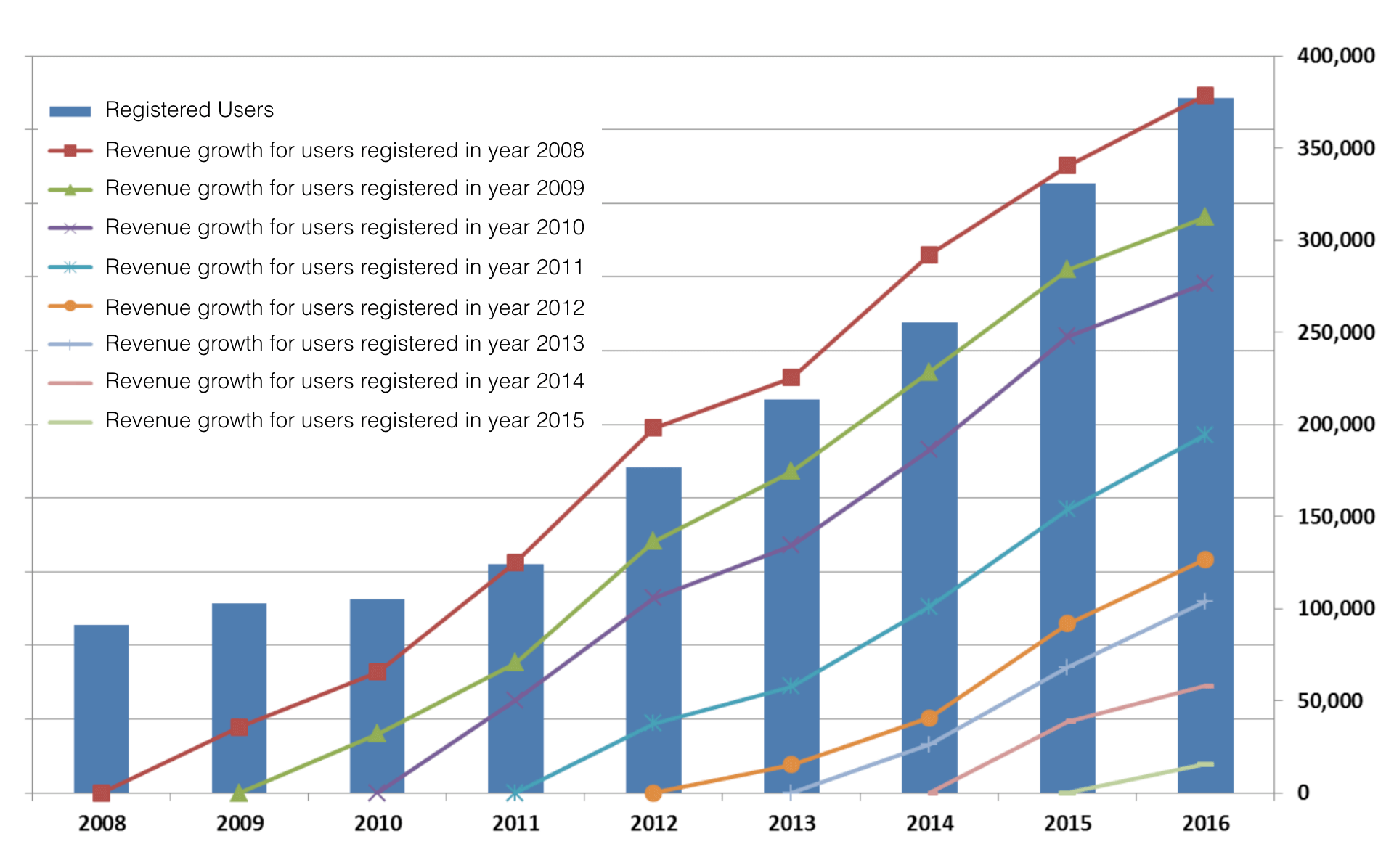

The graph below shows the cohorts of their customers by year and how much of their purchasing has increased over time. As you can see, customers increase their purchases every year.

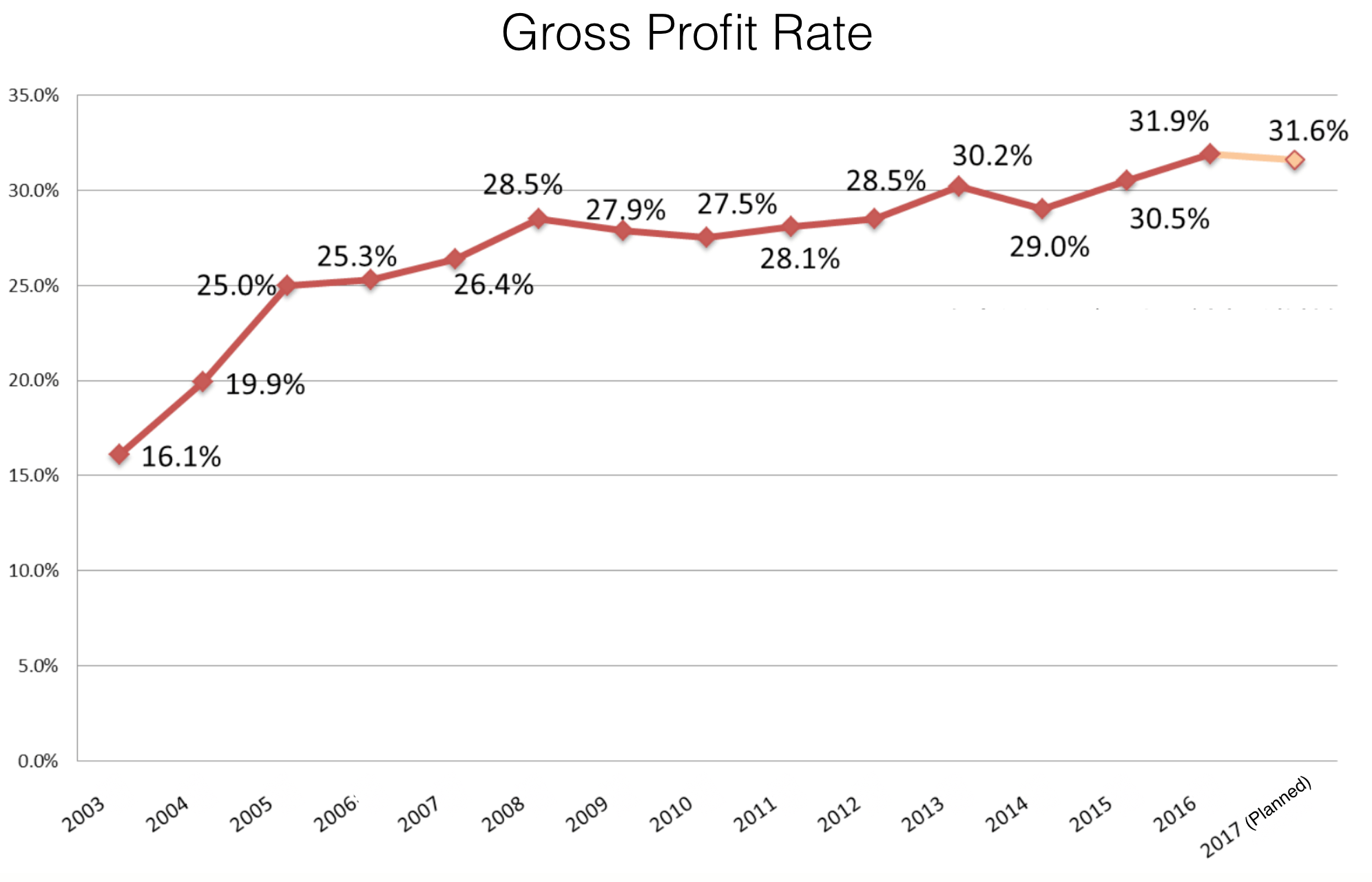

An interesting thing about this company is how they were able to increase their gross profit margin over time. One of the reasons they were able to achieve this is the launch of their private brands or private-labeled items. These are items manufactured (most likely by contract manufacturer) under MonotaRO’s brand. MonotaRO has over 300,000 items such as bolts, masking tapes, hand sanitizers, etc. under their brand.

In 2015, they have reported that 23% of their total revenue come from their private brands.

MonotaRO is after a market that is estimated to be more than $50B in Japan. With their strong business fundamentals and dominant position in the market, their growth should continue for a long time.